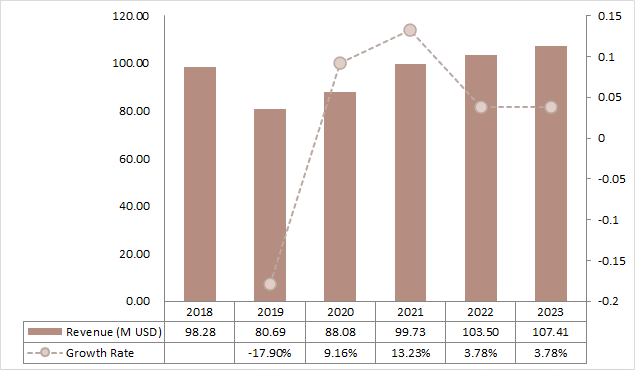

1 Global Top 3 Companies Market Share by Semiconductor Tape Revenue in 2022

The top 3 global semiconductor tape manufacturers by market share in 2022 are Lintec, Nitto, and Furukawa Electric. Lintec held the largest share with 32.36%, followed by Nitto with 25.37%, and Furukawa Electric with 9.45%. Together, these three companies accounted for a significant portion of the market, with their combined share totaling 67.18% of the global semiconductor tape market revenue in 2022.

Figure Global Top 3 Companies Market Share by Semiconductor Tape Revenue in 2022

2 Lintec

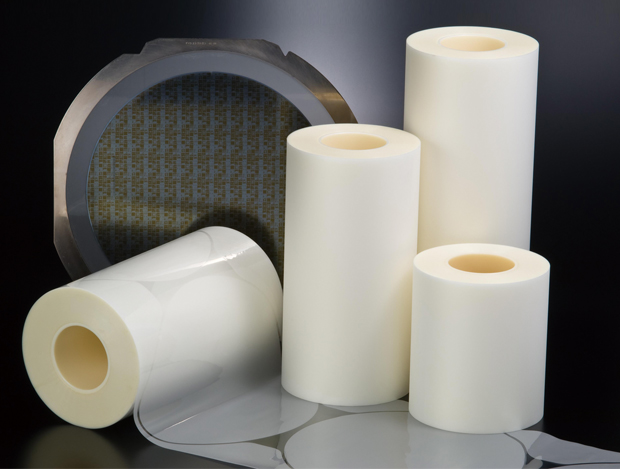

Lintec is a comprehensive manufacturer of adhesive-related products, established in 1934 and headquartered in Japan. The company operates on a global scale, offering a diverse range of products that include adhesive papers and films for seals and labels, shatter-proof window films, adhesive sheets for outdoor signs, interior finishing mounting sheets, and automotive adhesive products. Lintec also specializes in semiconductor-related tape and LCD-related adhesive products.

In addition to adhesive products, Lintec is involved in the production of specialty papers, such as color papers for envelopes and functional papers, as well as release papers and films. The company develops and provides a variety of products in the field of casting papers, including base papers for release papers used in adhesive materials and release papers and films.

Table Product Overview

|

Semiconductor related tape Various tapes that contribute to improving workability, productivity, and stabilizing quality, such as UV-curable dicing tape, high-performance wafer surface protection tape, dicing die bonding tape essential for semiconductor packages, and chip backside protection tape. lineup. |

|

|

Surface protection tape for BG It reliably protects the wafer surface during backgrinding and prevents contamination of the wafer surface due to infiltration of grinding water and grinding debris. |

|

|

Dicing tape Before dicing, the strong adhesive force securely holds the chips, and after dicing, the adhesive force is weakened to improve pick-up performance. |

|

|

Dicing/die bonding tape This is a high value-added tape that has the functions of a dicing tape and a die bonding agent. |

|

|

Chip backside protective tape This tape was developed for the purpose of protecting and reinforcing the back side of chips for applications such as flip chips, where chips are mounted on a board from the circuit side. |

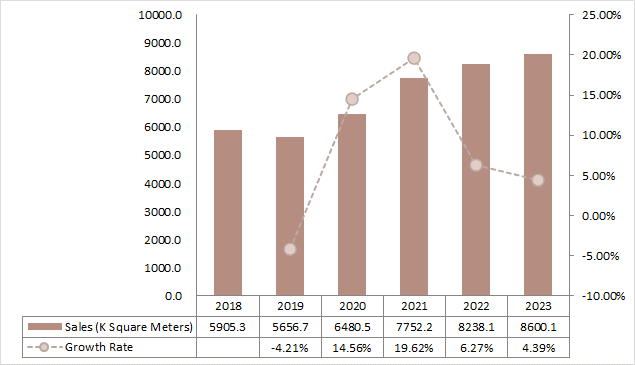

In 2018, Lintec recorded sales of 5,905.3 thousand square meters. Despite a slight dip in 2019, with sales at 5,656.7 thousand square meters, Lintec rebounded strongly in 2020, reaching 6,480.5 thousand square meters.

Figure Lintec Sales and Growth Rate 2018-2023

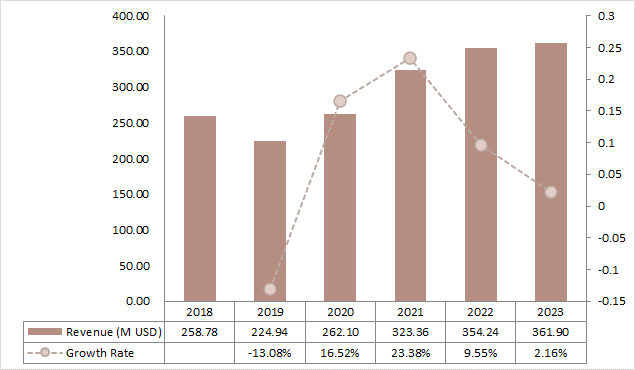

The company’s revenue also followed a similar trajectory, starting at $258.78 million in 2018, experiencing a decrease to $224.94 million in 2019, and then climbing to $262.10 million in 2020. A significant leap was observed in 2021, with revenue at $323.36 million, and it continued to rise to $354.24 million in 2022. By 2023, Lintec’s revenue stood at $361.90 million, reflecting a strong financial performance.

Figure Lintec Revenue and Growth Rate 2018-2023

3 Nitto

Nitto is a well-established company with a long history dating back to its foundation in 1918. Headquartered in Japan, Nitto has a global market reach and is recognized for its high-performance materials. The company has a diverse product portfolio that includes tapes, but is not limited to, vinyl, liquid crystal displays, insulation materials, and semiconductor-related products.

Nitto’s business overview includes a commitment to innovation and expansion, as evidenced by its acquisition of Bend Labs, Inc. in June 2022, 2022. This strategic move to merge with Bend Labs and form Nitto Bend Technologies signifies Nitto’s proactive approach to developing next-generation technologies and products, leveraging sensor device technologies to explore new business opportunities.

Table Product Overview

|

Heat Resistance Back Grinding Tape Heat resistance back grinding tape can correspond to the secondary process of wafer backside. After the back-grinding process, the wafers with the heat resistance back grinding tape can be processed (wet etching, ashing, metalizing, exposure/processing and so on). Features Excellent TTV (Total Thickness Variation) performance. High heat resistance for the wafer backside process. Easy peeling off from ground wafers after several kinds of wafer backside processes. Applications Wet etching or metalizing process of wafer backside of power devices, discrete devices, etc. Complicated process in backside of wafer, like IGBT etc. Other semiconductor processes which require a certain amount of heating. |

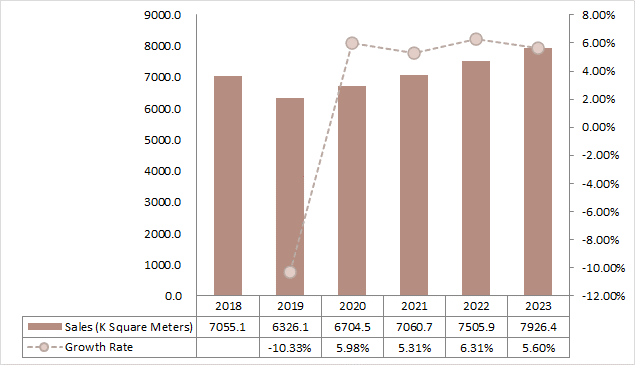

Nitto has demonstrated a strong market presence with its sales figures reflecting a competitive standing. The company’s sales in 2018 were 7,055.1 thousand square meters, which slightly decreased to 6,326.1 thousand square meters in 2019. However, Nitto showed resilience and growth in the following years, with sales reaching 7,060.7 thousand square meters in 2021 and further increasing to 7,926.4 thousand square meters in 2023.

Figure Nitto Sales and Growth Rate 2018-2023

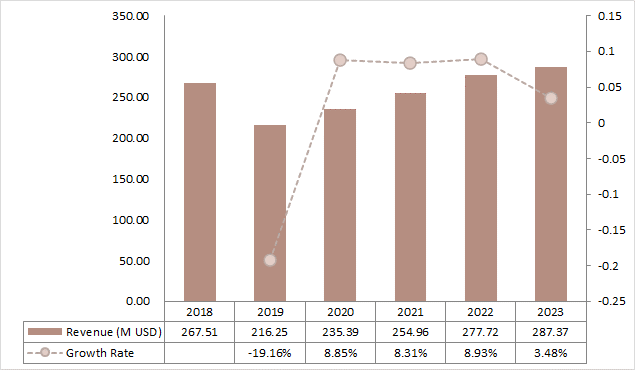

Nitto’s revenue in 2018 was $267.51 million, marking a strong starting point. However, Nitto encountered a significant decline in 2019, with revenue dropping to $216.25 million, reflecting a -19.16% growth rate. This downturn was a notable setback, but Nitto showed resilience with a recovery in 2020, achieving $235.393 million, an 8.85% increase.

Nitto maintained this positive momentum, achieving an 8.93% growth rate in 2022, which translated to a revenue of $277.72 million. The company’s financial performance in 2023 was slightly more modest, with a 3.48% growth rate and a revenue of $287.37 million.

The overall trend, despite the initial decline, has been positive, with Nitto demonstrating a capacity to adapt and expand its market presence. The consistent growth in the latter years, particularly the strong rebound in 2020 and the sustained increases through 2022, underscores Nitto’s strategic efforts and the potential for continued success in the semiconductor tape industry.

Figure Nitto Revenue and Growth Rate 2018-2023

4 Furukawa Electric

Furukawa Electric, a company with a rich history dating back to its establishment in 1896, is headquartered in Japan and operates on a global scale. The company is known for its electric and electronic equipment, and it has a significant presence in the semiconductor tape market.

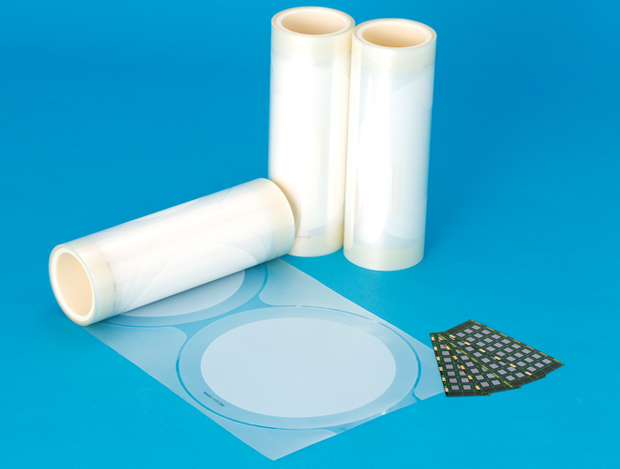

Furukawa Electric offers a diverse range of products, with a particular focus on those that serve the semiconductor and electronics industries. Including, Tape for Backgrinding, this product is designed to be suitable for thin wafer grinding, which is caused by stress relaxation. It is also known for its good detaping properties and its versatility across various devices. Tape for Dicing which is used to hold semiconductor wafers during the dicing process, these tapes offer strong adhesion before UV irradiation and easy peel-off after UV irradiation. They are available in various lines for special applications such as glass or wafers with metal. And Dicing Die Attach Film is an adhesive film used for semiconductor processes, often combined with dicing tape. It is optimized for excellent pick-up performance and is applicable to various dicing processes, including blade and stealth laser dicing. Conductive Die Attach Film is also available.

Table Product Overview

|

Tape for Backgrinding Feature Suitable for thin wafer grinding caused by stress relaxation Good for detaping Suitable for various device |

|

Tape for Dicing This tape is used to hold semiconductor wafer during dicing/singulation process. Feature Strong Adhesion before UV Irradiation Easy Peel-off after UV Irradiation Various Line-up for Special Application such as Glass, Wafer with Metal etc. |

|

Dicing Die Attach Film Die Attach Film is adhesive film which is used for semiconductor process. It is combined with dicing tape, and it is called as Dicing Die Attach Film. Feature Optimized dicing tape for Die Attach Film achieves excellent pick up performance Applicable dicing process is not only blade and also stealth laser dicing Conductive Die Attach Film is also available |

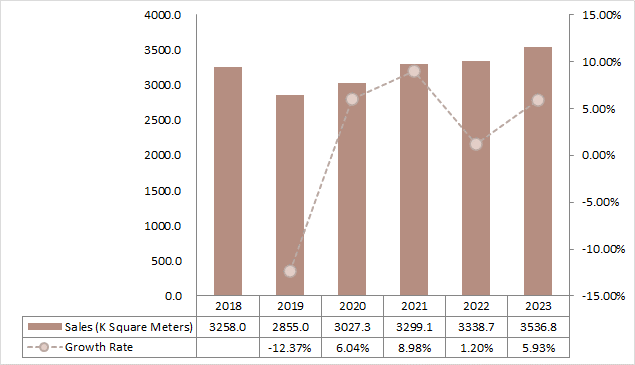

From 2018 to 2023, Furukawa Electric has shown a commendable performance in terms of sales volume. In 2018, the company recorded sales of 3,258 thousand square meters, which experienced a slight decrease in 2019 to 2,855 thousand square meters. However, Furukawa Electric demonstrated a strong recovery and growth in the subsequent years, reaching 3,299.1 thousand square meters in 2021 and further increasing to 3,536.8 thousand square meters in 2023.

Figure Furukawa Electric Sales and Growth Rate 2018-2023

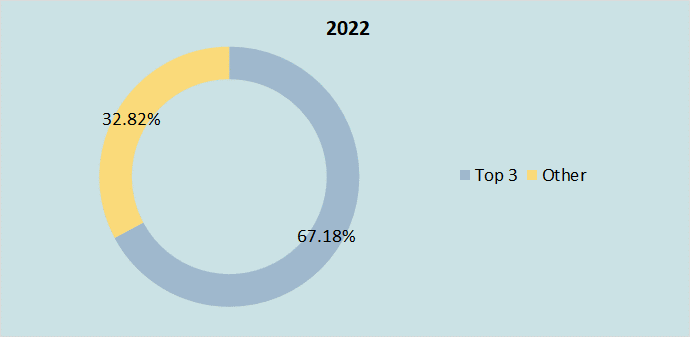

Furukawa Electric started with a revenue of $98.28 million in 2018, which was followed by a significant decline to $80.69 million in 2019, marking a -17.90% growth rate. This downturn was a critical juncture, but Furukawa Electric managed to turn things around in 2020, achieving a revenue of $88.08 million, an increase of 9.16%.

The upward trajectory continued into 2021, when the company experienced a substantial growth rate of 13.23%, leading to a revenue of $99.73 million. This positive momentum was sustained in 2022, with a growth rate of 3.78% and a revenue of $103.50 million. The year 2023 saw a moderate increase, with a growth rate of 3.78%, resulting in a revenue of $107.41 million.

The initial decline in 2019 was a challenge, but the company’s ability to bounce back with a strong recovery in 2020 and maintain growth through 2023 demonstrates its market adaptability and potential for continued success.

Figure Furukawa Electric Revenue and Growth Rate 2018-2023