1 High-purity Dispersible Boehmite Market Scope

High-purity dispersible boehmite is an aluminum oxide hydroxide primarily used as a catalyst and a precursor to ceramic materials. It is a white, crystalline powder that is insoluble in water but dispersible in solvents. High-purity dispersible boehmite finds applications in various industries such as electronics, automotive, aerospace, and chemicals due to its heat resistance, and excellent chemical stability.

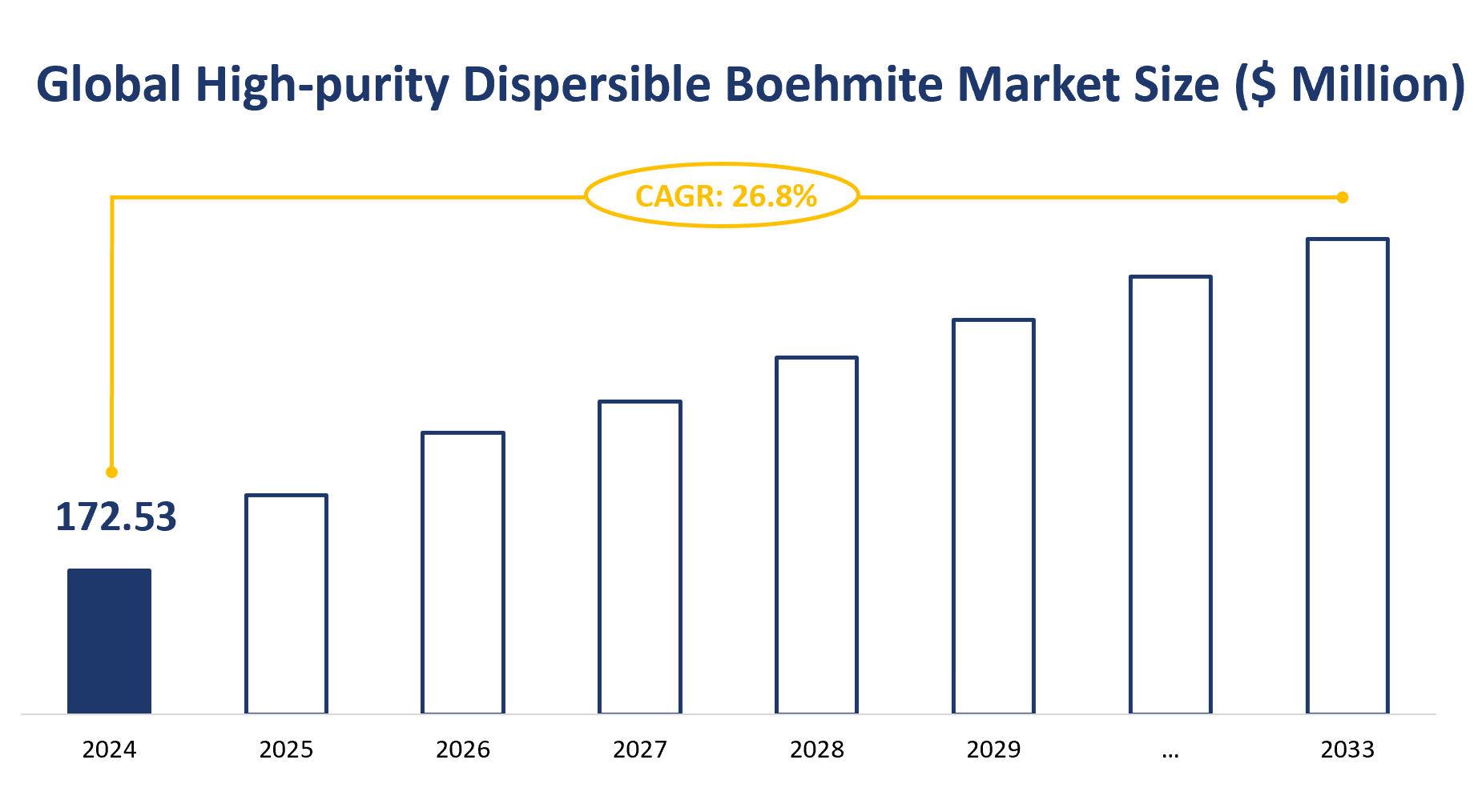

In 2024, the global high-purity dispersible boehmite market is anticipated to experience significant growth, with a market size of 172.53 million USD. This figure sets the stage for a period of expansion that is projected to continue over the following years. The market is characterized by a robust CAGR of 26.8% from 2024 to 2033, indicating a strong upward trajectory in the market value.

Figure Global High-purity Dispersible Boehmite Market Size ($ Million) and CAGR (2024-2033)

2 Downstream Buyers Analysis for High-purity Dispersible Boehmite

Downstream applications are extremely extensive, mainly used in the Li-Ion battery separator, electronic ceramics, refractory materials, catalysts, abrasives, and other fields.

Table Major Downstream Buyers of High-purity Dispersible Boehmite with Contact Information

Downstream Buyers | Contact Information |

Maruwa |

|

CeramTec |

|

Remtec |

|

RAYPCB |

|

SEMCORP |

|

ENTEK |

|

REPT BATTERO |

|

3 Global High-purity Dispersible Boehmite Market Analysis by Type

Table Different Types of High-purity Dispersible Boehmite

Types | Description |

99.0%-99.9% | The high-purity dispersible boehmite market can be categorized based on its purity levels. The first category is known as “Purity (99.0%-99.9%)” which refers to boehmite with a purity range between 99.0% and 99.9 %. The second category is labeled “Purity (above 99.9%)” which signifies boehmite with a purity level exceeding 99.9%. Both categories are used to differentiate boehmite based on its purity concentration, with higher purity levels often indicating enhanced quality and performance in various applications. |

Above 99.9% |

99.0%-99.9% purity dispersible boehmite will contribute 62.20 M USD to the market in 2024. Despite being a significant portion, it represents a smaller share compared to the higher purity category. The value indicates a substantial market for this level of purity, which may be sufficient for certain industrial applications that do not require the utmost purity.

Above 99.9% purity dispersible boehmite is the more dominant of the two, contributing 110.33 M USD to the market. The higher revenue from this category suggests a strong demand for ultra-high purity boehmite, likely due to its critical role in high-performance applications where impurities can significantly affect the quality and reliability of the end product.

Table Global High-purity Dispersible Boehmite Value (M USD) by Type in 2024

| 2024 |

99.0%-99.9% | 62.20 |

Above 99.9% | 110.33 |

Total | 172.53 |

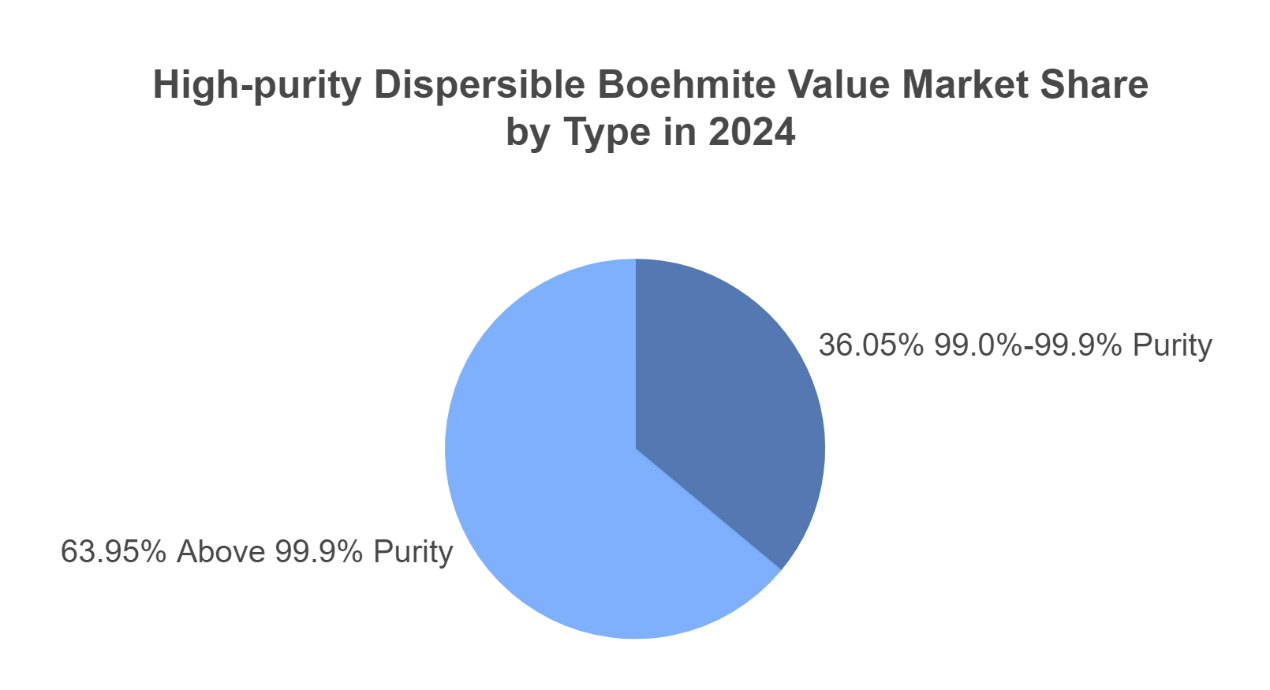

The category for dispersible boehmite with a purity level above 99.9% accounts for a dominant 63.95% of the market in 2024. This significant share indicates a strong market demand for the highest purity levels, which are essential for applications where impurities can critically affect performance, such as in advanced ceramics, electronics, and other high-tech industries.

Conversely, the 99.0%-99.9% purity range holds a market share of 36.05% in 2024. While this is a smaller portion compared to the higher purity category, it still represents a substantial segment of the market. This suggests that there is a considerable demand for this level of purity, likely serving a broader array of applications where the cost of ultra-high purity might not be justified.

Figure Global High-purity Dispersible Boehmite Value Market Share by Type in 2024

4 Global High-purity Dispersible Boehmite Market Analysis by Application

The Li-ion Battery Separator is the leading consumer of the high-purity dispersible boehmite market, accounting for a significant 43,271 tons of boehmite. This high demand is indicative of the critical role boehmite plays in the production of lithium-ion batteries, where it is used to enhance battery performance and safety.

Electronic Ceramics follow with a consumption of 5,608 tons, reflecting boehmite’s utility in the electronics industry for its insulating and dielectric properties. Refractory Materials, which are essential for high-temperature applications, consume 3,530 tons, highlighting boehmite’s resilience and thermal stability.

Catalysts, where boehmite may function as a support or active component in chemical reactions, account for 3,786 tons of consumption. Abrasives, benefiting from boehmite’s hardness and durability, use 1,430 tons. The ‘Others’ category, which includes a variety of applications not listed specifically, consumes 3,622 tons.

Table Global High-purity Dispersible Boehmite Consumption (Tons) by Application in 2024

| 2024 |

Li-Ion Battery Separator | 43271 |

Electronic Ceramics | 5608 |

Refractory Materials | 3530 |

Catalysts | 3786 |

Abrasives | 1430 |

Others | 3622 |

Total | 61247 |

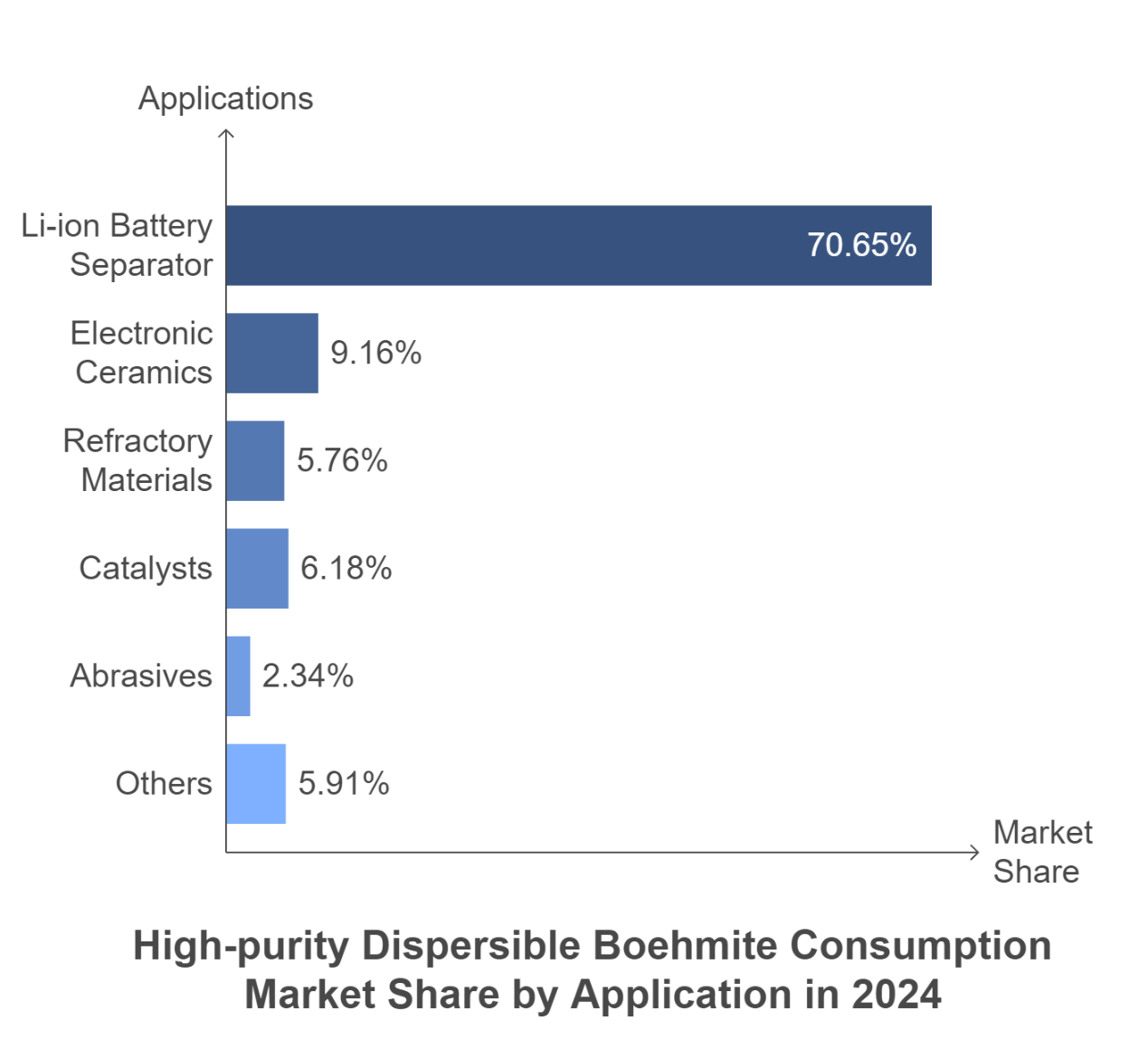

The market is dominated by the Li-ion Battery Separator application, which accounts for a substantial 70.65% of the total market share. This significant portion underscores the critical role of high-purity boehmite in the lithium-ion battery industry, where it is likely used in the production of battery separators that require high purity for optimal performance and safety.

Electronic Ceramics represent the second-largest application with a 9.16% share, indicating a notable demand for boehmite in the electronics sector, possibly for its insulating properties and stability in electronic components. Refractory Materials, which are materials that can withstand high temperatures, hold a 5.76% share, reflecting boehmite’s use in industrial furnaces and other high-temperature applications. Catalysts, where boehmite may be used to support or enhance chemical reactions, make up 6.18% of the market share, showing its importance in the chemical industry.

Abrasives, which use boehmite for its hardness and durability, account for a smaller 2.34% of the market share. Lastly, the ‘Others’ category, encompassing a variety of other applications, represents 5.91% of the total market.

Figure Global High-purity Dispersible Boehmite Consumption Market Share by Application in 2024

5 Global High-purity Dispersible Boehmite Market Analysis by Regions

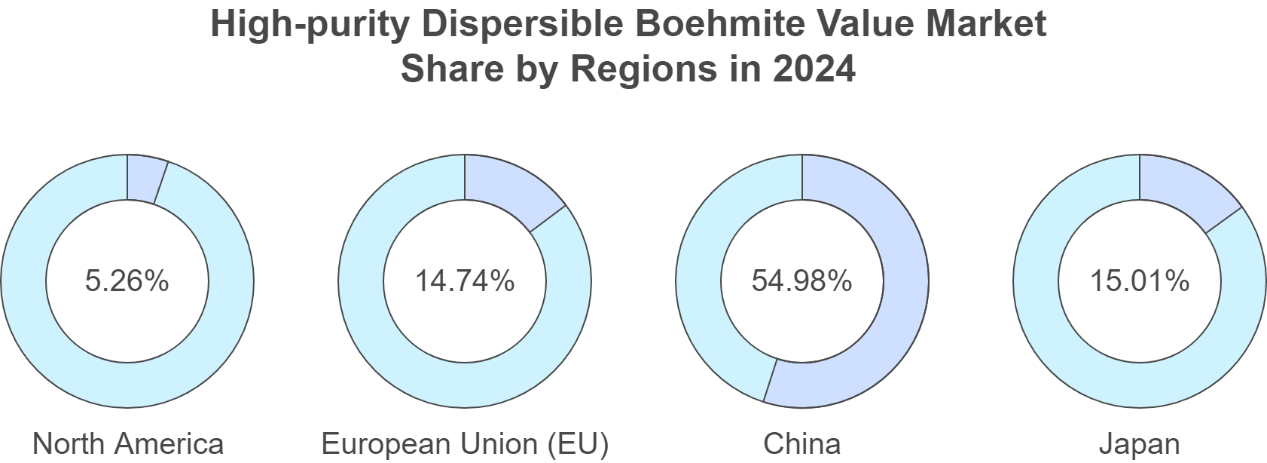

In 2024, the Global High-purity Dispersible Boehmite market is led by China, which commands a significant market share of 54.98%. This dominant position underscores China’s pivotal role in the boehmite industry, likely due to its robust industrial sector and growing demand for high-purity materials in various applications.

Following China, Japan holds a substantial share of 15.01%, reflecting its consistent demand for boehmite in sectors such as electronics and ceramics, where high purity is essential for performance.

The European Union (EU) accounts for 14.74% of the market, indicating a strong presence and reliance on high-purity boehmite within the region. This share suggests that the EU is a key consumer of boehmite, possibly for its advanced manufacturing and technology sectors.

North America, while still a significant player, has a smaller share of 5.26%. Despite this, the region remains important due to its demand for boehmite in industries like automotive and aerospace, where high purity is crucial for quality and safety.

Figure Global High-purity Dispersible Boehmite Value Market Share by Regions in 2024

Japan stands out as the leading exporter with a substantial 7,575 tons, indicating a robust export market for high-purity dispersible boehmite. This could be attributed to Japan’s advanced manufacturing capabilities and a strong demand for boehmite in various industries.

The European Union (EU) is also a significant exporter, with 5,567 tons, reflecting its active role in the global boehmite market. The EU’s exports suggest a healthy production and distribution network for high-purity materials.

China contributes 1,842 tons to the global export market, showcasing its growing influence in the boehmite industry. North America, with 454 tons, has the smallest export volume among the listed regions.

Table Global High-purity Dispersible Boehmite Export (Tons) by Regions in 2024

2024 | |

North America | 454 |

European Union (EU) | 5567 |

China | 1842 |

Japan | 7575 |

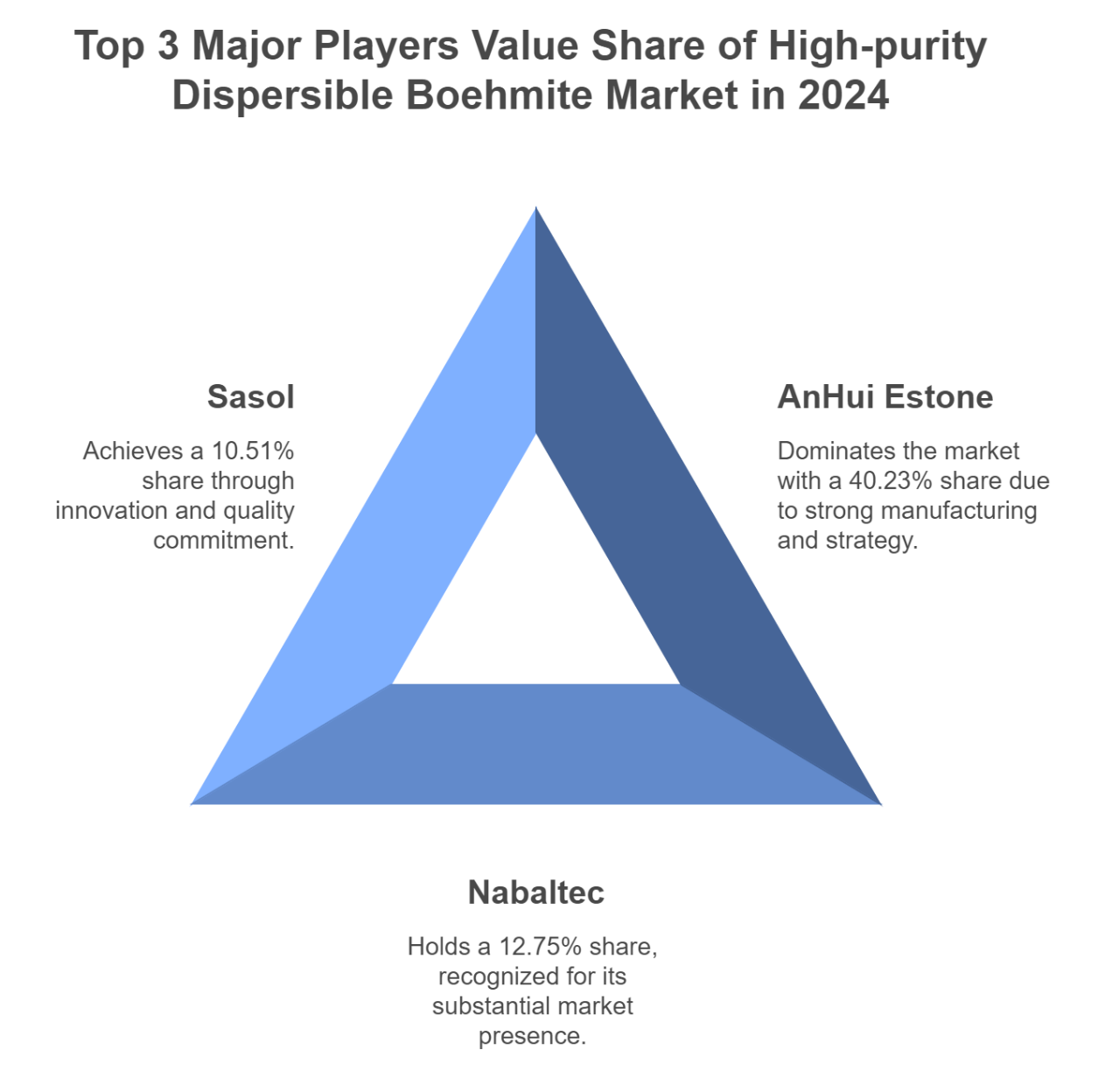

6 Top 3 Major Players of High-purity Dispersible Boehmite Market

In 2024, the Global High-purity Dispersible Boehmite market is dominated by three major players, each with a significant market share. AnHui Estone leads the market with a substantial share of 40.23%, showcasing its dominance and the success of its manufacturing and strategic initiatives. This significant share indicates that AnHui Estone is a major force in the boehmite market, likely due to its strong production capabilities and effective market strategies.

Nabaltec holds a considerable market share of 12.75%, recognized for its substantial market presence. This suggests that Nabaltec has a well-established position in the industry, possibly due to its reliable supply and quality products.

Sasol follows with a share of 10.51%, achieving this through innovation and a commitment to quality. This indicates that Sasol is a key player in the market, with a focus on developing new technologies and maintaining high standards in its products.

Together, these three companies account for 63.49% of the total market share, highlighting their significant influence and the competitive nature of the high-purity dispersible boehmite market. The market shares of these top players reflect their individual strengths and contributions to the industry, with AnHui Estone’s leadership, Nabaltec’s established presence, and Sasol’s innovation-driven approach.

Figure Top 3 Major Players Value Share of High-purity Dispersible Boehmite Market in 2024