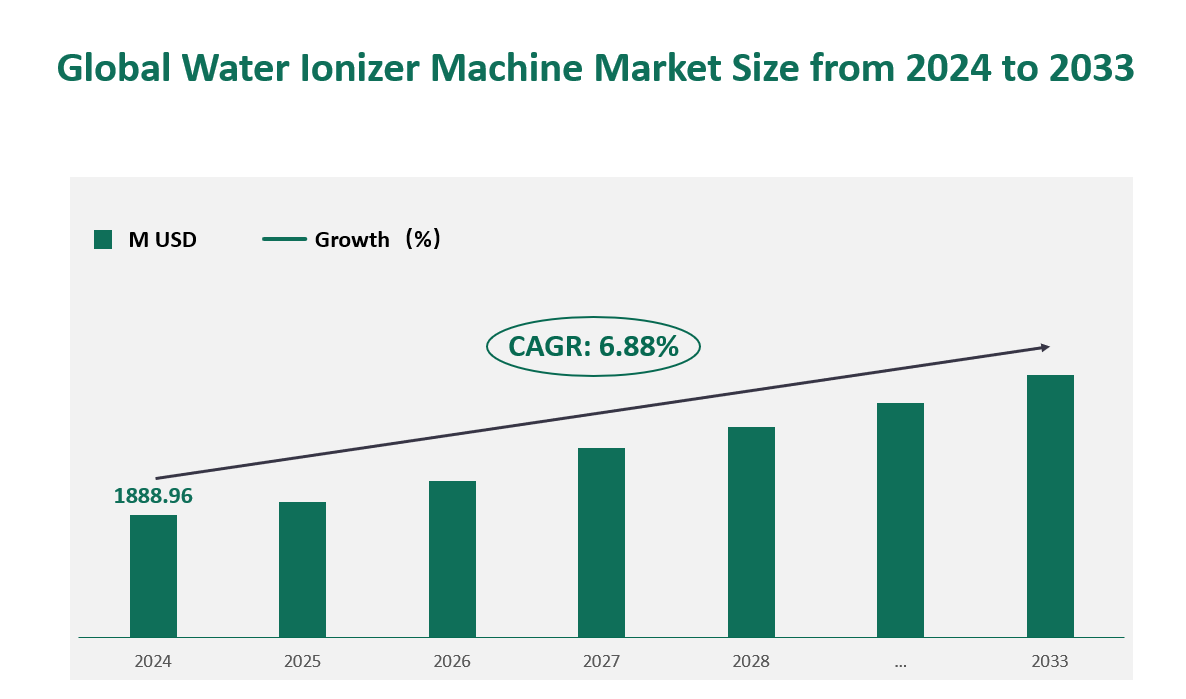

1 Global Water Ionizer Machine Market Size (Revenue) and CAGR (2024-2033)

Global Water Ionizer Machine market generated revenue of USD 1888.96 Million in 2024 with a CAGR of 6.88% during 2024 to 2033.

This growth can be attributed to several factors, including increasing health awareness among consumers, the advancement of water ionization technology, and the desire for customizable pH levels in drinking water. The market is also influenced by the rapid development of e-commerce, which allows for easier distribution and access to a broader customer base. However, the market faces challenges such as the availability of alternative water treatment solutions and the high cost associated with Water Ionizer Machines, which may hinder the adoption rate. Despite these challenges, the market is expected to continue its upward trajectory due to the growing demand for healthy and clean drinking water solutions.

Figure Global Water Ionizer Machine Market Size (M USD) Outlook (2024-2033)

2 Water Ionizer Machine Industry Trends

With the continuous improvement of consumers’ health awareness and the continuous maturity of Water Ionizer Machine technology, the Water Ionizer Machine market will usher in a broader development space in the future. The following are the key trends in the development of Water Ionizer Machine.

Technological Advancements: Water Ionizer Machine technology continues to advance, including improved filtration methods, electrolysis processes and user-friendly features. Manufacturers are integrating advanced technologies to improve water quality, convenience and user experience.

Customizable pH Levels: Water Ionizer Machine with customizable pH levels are gaining popularity among consumers who seek precise control over the alkalinity of their drinking water. Customizable pH Water Ionizer Machine allow users to adjust the pH to their preferences and health requirements.

Enhanced Filtration Capabilities: In the future, manufacturers will focus on developing Water Ionizer Machines with advanced filtration systems. The Water Ionizer Machine with an advanced filtration system not only ionizes water but also removes impurities, pollutants and heavy metals from tap water. These systems ensure clean and purified alkaline water.

Smart and Connected Devices: In recent years, with the continuous development of technologies such as the Internet of Things and artificial intelligence, intelligence has become a major trend in the development of Water Ionizer Machine. The smart Water Ionizer Machine provides mobile app connectivity, real-time monitoring, and data tracking. These devices provide users with control, convenience, and insights into their water consumption.

3 Global Water Ionizer Machine Market by Type in 2024

The global Water Ionizer Machine market is segmented into two primary types: Counter Top Water-Ionizer and Under Counter Water-Ionizer, each with distinct features and market penetration.

Counter Top Water-Ionizer: This type of water ionizer is designed for placement on countertops, offering convenience and ease of use in residential settings. They are compact, user-friendly, and often come with features like digital displays and adjustable pH levels. In 2024, the Counter Top Water-Ionizer segment held a significant market share, with a revenue of $1048.03 million USD, accounting for 55.48% of the total market revenue. This dominant share reflects the preference for countertop models among consumers due to their visibility, ease of use, and space efficiency.

Under Counter Water-Ionizer: These models are installed under the countertop, providing a more integrated and aesthetically pleasing solution, particularly in kitchens with limited space or a desire for a cleaner look. Despite their lower market share compared to countertop models, the Under Counter Water-Ionizer segment generated a revenue of $840.93 million USD in 2024, capturing 44.52% of the market. This type is favored for its space-saving design and is often chosen for commercial applications where a more streamlined appearance is desired.

The market size and share data for 2024 indicate a balanced preference for both types, with countertop models leading in terms of revenue but under-counter models showing potential for growth, especially in commercial and space-conscious settings.

Table Global Water Ionizer Machine Market Size and Share by Type in 2024

Type | Revenue (M USD) | Market Share |

|---|---|---|

Counter Top Water-Ionizer | 1048.03 | 55.48% |

Under Counter Water-Ionizer | 840.93 | 44.52% |

4 Global Water Ionizer Machine Market by Application in 2024

The applications of Water Ionizer Machines are diverse, with the market segmented into Household, Hospital, and Commercial sectors, each serving different needs and contributing to the market’s overall growth.

Household: The household application is the largest segment, with a market sales of 404.1 K Units in 2024, holding a significant market share of 62.56%. This application caters to the increasing health consciousness among consumers who seek improved water quality for drinking and cooking. Household ionizers are designed to be compact and user-friendly, often featuring adjustable pH levels to meet various household needs.

Hospital: In the healthcare sector, water ionizers play a crucial role, with a market sales of 72.3 K Units in 2024, representing an 11.19% market share. Hospitals utilize these machines for their ability to produce water with specific pH levels, essential for various medical procedures and treatments. The demand for hospital-grade ionizers is driven by the need for sterile and controlled water quality in healthcare settings.

Commercial: The commercial application, including businesses like coffee shops, restaurants, and offices, has a market sales of 141.4 K Units in 2024, with a market share of 21.89%. The growth in this segment is attributed to the increasing demand for ionized water in food service establishments and the perception of providing cleaner water to consumers.

The market size and share data for 2024 show a clear dominance of the household application, with the commercial sector also showing significant potential for growth, driven by the rising demand for ionized water in the food and beverage industry.

Table Global Water Ionizer Machine Market Consumption and Share by Application in 2024

Application | Market Share | |

|---|---|---|

Household | 404.1 | 62.56% |

Hospital | 72.3 | 11.19% |

Commercial | 141.4 | 21.89% |

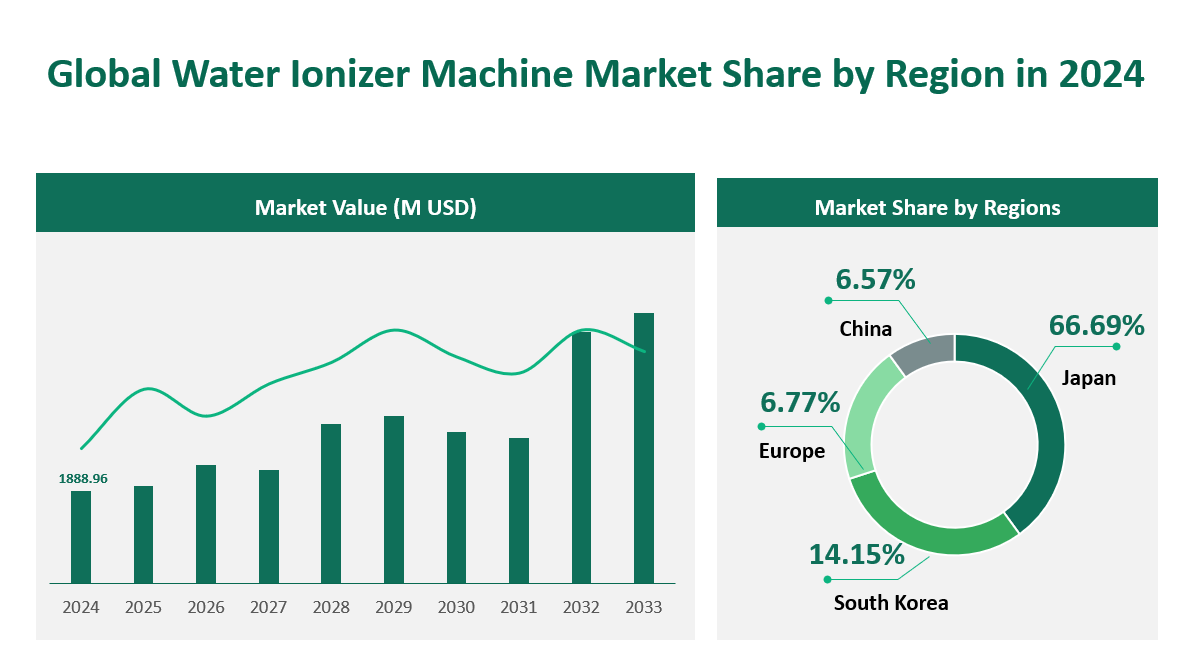

5 Global Water Ionizer Machine Market by Region in 2024

The global Water Ionizer Machine market is distributed across various regions, with each region exhibiting unique market dynamics and growth potentials.

South Korea: South Korea is a key player in the market, with a revenue of $267.33 million USD in 2024, holding a 14.15% market share. The country’s advanced technology and health-conscious population contribute to the strong demand for water ionizer machines.

Europe: The European market, with a revenue of $127.85 million USD, accounts for a 6.77% share. The region’s market is driven by health awareness and the presence of established players in the water treatment industry.

China: China’s market size is $124.08 million USD, with a 6.57% share. The growing middle class and increasing health consciousness are key factors contributing to the market’s growth.

Japan: Japan dominates the market with a revenue of $1259.79 million USD, capturing a substantial 66.69% share. Japan’s long-standing tradition of using ionized water for health benefits and the presence of key manufacturers make it a significant market.

The regional market size and share data for 2024 highlight the dominance of Japan in the global market, with South Korea, Europe, and China also playing crucial roles. The varying market sizes across regions reflect differences in consumer preferences, health awareness, and the presence of key industry players. As the market continues to evolve, regional-specific strategies will be essential for capturing growth opportunities in the global Water Ionizer Machine market.

Table Global Water Ionizer Machine Market Size, Region Wise in 2024

Region | Revenue (M USD) | Market Share |

|---|---|---|

South Korea | 267.33 | 14.15% |

Europe | 127.85 | 6.77% |

China | 124.08 | 6.57% |

Japan | 1259.79 | 66.69% |

Others | 109.90 | 5.82% |

Figure Global Water Ionizer Machine Revenue Market Share by Region in 2024

6 Global Water Ionizer Machine Market Top 3 Players

Company Introduction and Business Overview: Kangen, a division of Enagic, is a renowned company in the water ionizer industry. Established in 1974 and headquartered in Japan, Kangen has a broad market distribution, primarily in the Asia Pacific, North America, and Europe. The company is well-known for its high-quality alkaline ionizers and water filters, holding ISO 9001, ISO 14001, and ISO 13485 certifications.

Products Offered: Kangen’s product portfolio includes a range of water ionizer machines, such as the flagship model, the K8 (Kangen 8), which features 8 platinum-dipped titanium plates for improved water ionization and increased antioxidant production potential. The K8 is capable of generating five types of water, including strong Kangen water, neutral water, beauty water, and strong acidic water, making it versatile for both household and commercial use.

Revenue in 2024: In 2024, Kangen (Enagic) recorded a revenue of $1111.95 million USD, solidifying its position as a market leader. The company’s revenue growth can be attributed to its strong product lineup, global presence, and commitment to quality and innovation.

Company Introduction and Business Overview: Nihon Trim, established in 1982 and based in Japan, is another significant player in the water ionizer market. The company focuses on manufacturing and selling electrolyzed reduction water equipment and has a strong market presence mainly in Asia.

Products Offered: Nihon Trim’s product lineup includes the TRIM ION TI-9000EX, which boasts features like an electrochemical hydrogen water intake rate of approximately 5.5L/min (max) and a cartridge filtration capacity of 12t per piece. The company’s products are known for their advanced filtration systems and innovative technologies that ensure consistent water quality.

Revenue in 2024: Nihon Trim achieved a revenue of $89.19 million USD in 2024. The company’s revenue growth is supported by its focus on technological advancements and meeting the specific demands of the Asian market, where it has a strong foothold.

Company Introduction and Business Overview: OSG Corporation, founded in 1970 and headquartered in Japan, is a prominent manufacturer and seller of water purifying equipment. The company’s market distribution spans across Asia-Pacific, Europe, and America, making it a global contender in the water ionizer industry.

Products Offered: OSG Corporation offers a variety of water ionizer machines, including industrial and commercial water purifiers, home and office water purifiers, and other hygiene management products. Their products are designed to cater to the needs of various industries, commercial establishments, and households.

Revenue in 2024: In 2024, OSG Corporation reported a revenue of $53.22 million USD. The company’s revenue growth is driven by its extensive product range, commitment to quality, and a wide-reaching market distribution strategy that covers several continents.

Table Global Water Ionizer Machine Revenue Share of Top3 Players in 2024

Company | 2024 |

Kangen (Enagic) | 58.87% |

Nihon Trim | 4.72% |

OSG Corporation | 2.82% |